Dilution is Your Friend

One the most common discussions we have with entrepreneurs relates to valuation of their A round. Series A stock is quite difficult to value - the company typically has no revenues, the team is incomplete, the story is compelling. These factors mash against each other on the whiteboard of valuation calculations in a bumbling way that eludes quantification.

And so, we’re left with a general sense of comparable industry values for early-stage companies. For the most part, Series A rounds are priced between $2MM and $5MM. There are many exceptions to this and venture-backed Series A rounds are nearly always priced higher (and they’re more mature or more attractive companies).

Most of the deals we see should be priced between $2MM and $4MM (we work with companies on the earlier side). And now to the common discussion – where to price the round. We make no secret about the fact that Atlas advocates under-pricing the security. The pain of watching a deal get stale after an energetic entrepreneur spends more than six months trying to raise $1MM is great but the long-term impact of an under-funded enterprise with a CEO that’s never out of fund-raising mode is greater. We believe that lower prices correlate to shorter funding cycles. I suppose that should be intuitive but what’s not intuitive is the relatively minor toll the founder pays for a lower share price.

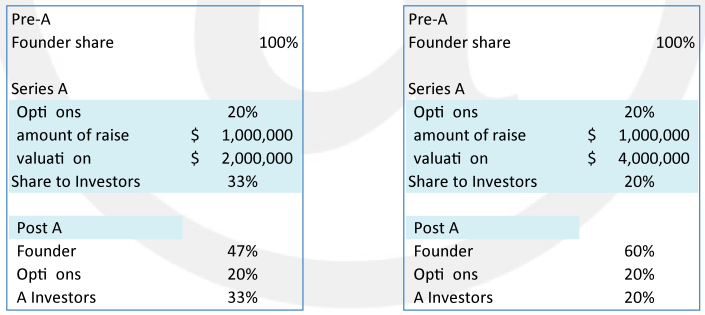

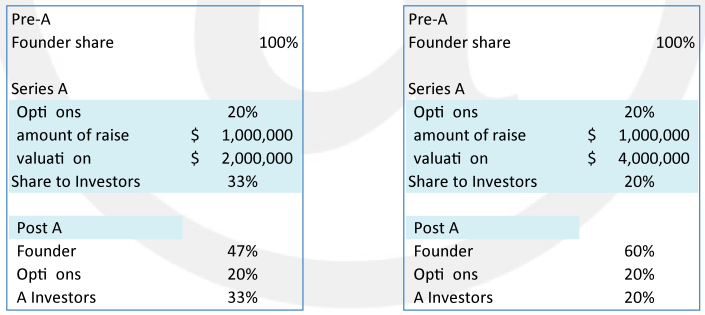

The mode for the size of an angel-backed Series A is about $1MM. Let’s assume that our Series A is to be followed by a $5MM Series B and that we have options to issue as well. Our founder starts out owning 100% of the business but sells $1MM in the Series A. Below you see the outcome using either a $2MM or $4MM pre-money valuation.

The founder’s share moves from 47% to 60% if the valuation doubles. Now, on to the Series B round where we raise $5MM at a $10MM pre-money valuation.

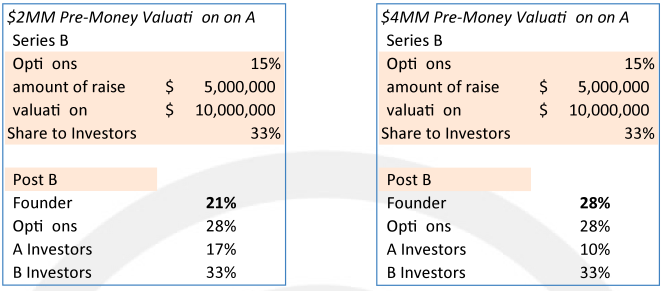

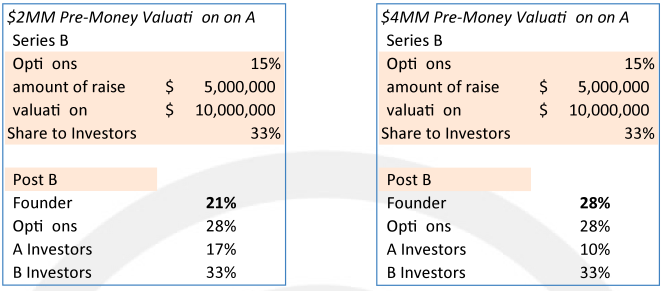

After the Series B, the founder’s share will have moved from 21% to 28% based on doubling the Series A valuation. And now let’s sell this company because, heck, that’s what we’re all here to do. Here’s a summary of the outcomes, post-Series B, of a sale at different sale prices.

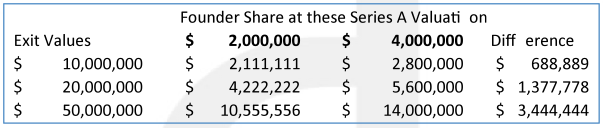

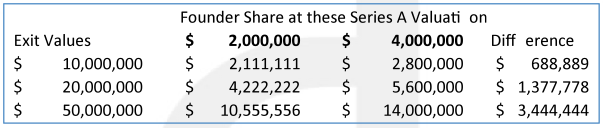

In this scenario, the $50MM exit is probably about the minimum that the venture investor would like (I won’t say accept because there have been too many exceptions). Now, think of the marginal utility of that $3.4MM to someone who just made $10.5MM. This difference is about the same as if the company sold for $20MM before the B round (the founder would make an extra $2.6MM after earning $9.3MM).

Halving the valuation of the Series A has a radical effect on the likelihood of closing that round and the time and effort involved in doing so. Since most startups fail to close their first funding rounds, entrepreneurs should consider lower valuations to ensure success (I’m not advocating halving: rather, reducing). On the contrary, the marginal utility of capital of, say, $3.4MM to a successful entrepreneur cashing a $10.5MM check is not “radical” – it’s the difference between “I never have to work again” and “fuck it, I’ll have the chef come to my house rather than go out”.

The founder’s share moves from 47% to 60% if the valuation doubles. Now, on to the Series B round where we raise $5MM at a $10MM pre-money valuation.

The founder’s share moves from 47% to 60% if the valuation doubles. Now, on to the Series B round where we raise $5MM at a $10MM pre-money valuation.

After the Series B, the founder’s share will have moved from 21% to 28% based on doubling the Series A valuation. And now let’s sell this company because, heck, that’s what we’re all here to do. Here’s a summary of the outcomes, post-Series B, of a sale at different sale prices.

After the Series B, the founder’s share will have moved from 21% to 28% based on doubling the Series A valuation. And now let’s sell this company because, heck, that’s what we’re all here to do. Here’s a summary of the outcomes, post-Series B, of a sale at different sale prices.

In this scenario, the $50MM exit is probably about the minimum that the venture investor would like (I won’t say accept because there have been too many exceptions). Now, think of the marginal utility of that $3.4MM to someone who just made $10.5MM. This difference is about the same as if the company sold for $20MM before the B round (the founder would make an extra $2.6MM after earning $9.3MM).

Halving the valuation of the Series A has a radical effect on the likelihood of closing that round and the time and effort involved in doing so. Since most startups fail to close their first funding rounds, entrepreneurs should consider lower valuations to ensure success (I’m not advocating halving: rather, reducing). On the contrary, the marginal utility of capital of, say, $3.4MM to a successful entrepreneur cashing a $10.5MM check is not “radical” – it’s the difference between “I never have to work again” and “fuck it, I’ll have the chef come to my house rather than go out”.

In this scenario, the $50MM exit is probably about the minimum that the venture investor would like (I won’t say accept because there have been too many exceptions). Now, think of the marginal utility of that $3.4MM to someone who just made $10.5MM. This difference is about the same as if the company sold for $20MM before the B round (the founder would make an extra $2.6MM after earning $9.3MM).

Halving the valuation of the Series A has a radical effect on the likelihood of closing that round and the time and effort involved in doing so. Since most startups fail to close their first funding rounds, entrepreneurs should consider lower valuations to ensure success (I’m not advocating halving: rather, reducing). On the contrary, the marginal utility of capital of, say, $3.4MM to a successful entrepreneur cashing a $10.5MM check is not “radical” – it’s the difference between “I never have to work again” and “fuck it, I’ll have the chef come to my house rather than go out”.