Comp Plans

September 2009

To most entrepreneurs, human resources means pay and benefits and only the basics at that. There’s a lot to be gained by embracing a full spectrum of HR but, for now, let’s go deeper on pay and talk about a Comp Plan.

A Comp Plan proactively adds some structure to the way we pay people. If we do it right, we add just enough structure to get the benefits without impeding the fast-moving culture that gives us an advantage.

- So, why do we need a Comp Plan?

- • Provides a shorthand to refer to positions inferring relative compensation with enough meaning for discussions.

- • Allows your board to approve a hiring plan, thus executing their fiduciary duty, without necessarily approving each hire individually (this will drive you crazy if you have to do this and your board is negligent if they don’t approve your hiring in a responsible fashion).

- • Supports the need for a quantifiable company goal.

- • Standardizes benefits and limits intra-company pay inequality.

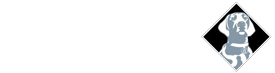

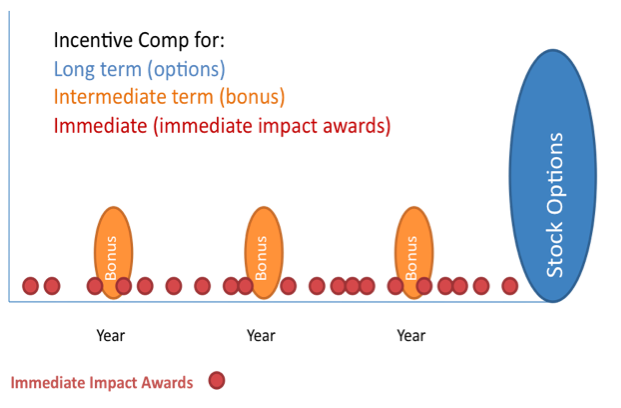

The next point in our Comp Plans is incentive compensation. Every person in the organization needs three temporal-based types of incentive comp: long term (stock options), intermediate term (annual bonus) and immediate term (immediate impact awards or spot awards).

First, when I say every person, I really mean everybody. Some companies limit options to the executive team. But that’s neglecting the huge impact that a modest grant can have on lower-level staff. It’s a mistake to exclude any full-timers. Everyone can and should have all three types of incentive comp.

Immediate impact awards are intended to fulfill a manager’s responsibility to “catch people doing things right” (credits to Keith Blanchard). The existence of a program makes it easier for managers to notice and reward staff and the presence of items to buy means there is accounting. And where there’s accounting, there’s reporting. Immediate Impact Awards help us with reporting tools for the CEO to know which managers are routinely rewarding their teams.

Bonuses don’t exist so that we can over-reward people with compensation that the market doesn’t require. Our concept of bonus is tied to pay at risk. If we need to compensate an engineer at $100k, we’ll offer him a base pay of $90k and, say, a 15% bonus. Now, if he and the company do essentially what they’re supposed to do, he’ll make a little more but if one or both fails, he’ll make less. His $10k is at risk. Junior staffers can still be part of this concept but with much smaller amounts at risk. When we pay bonuses, we allow them to pay over target amounts (we usually cap at 150% of target) for times when the individual and/or the company exceeded plan.

When we talk about performance, we have two factors: company and individual. Most of us understand individual assessments and the annual performance review process. One of our rules here is that performance reviews are done on an annual cycle, not on anniversary dates. It’s hard enough to get managers to produce these reviews when we have everyone in the company focused on it. They simply don’t happen (yes, we’ve tried) without an annual event and forcing function that company-wide publicity provides.

But how about that other component? The company’s performance is often overlooked or it’s sort of factored in after the fact with a board or management that decides bonuses need to be cut or not paid. Get proactive. Determine what the company’s quantifiable objective is for the year. This is a great opportunity for your massive whiteboard thermometer that you can update every week or month. It’s the goal that everyone sees in the breakroom. It’s the target that shows up at the top of everyone’s individual performance objectives.

These goals can be one thing (say, revenue) or several. The target can be quantified as stated or it can be something qualitative (like release v 2.0 by October 1) that become quantitative.

Microgreen Polymers used three items, each weighted 1/3 in their first Company Performance Factor (CPF): revenue; margins; and operating expenses. The board approved the targets and we measured against them monthly and drilled down on each at weekly management meetings. The CPF provided a great vehicle to unite the shop floor working with the Chairman of the Board.

With regard to stock options, most firms issue them at time of hire but they lack any strategy for issuances after that. If we assume that the company’s benefit of issuing stock options is employee retention then we need to appreciate the need for follow-on options.

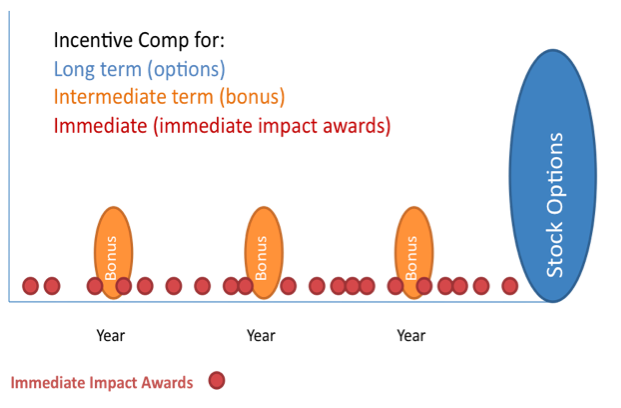

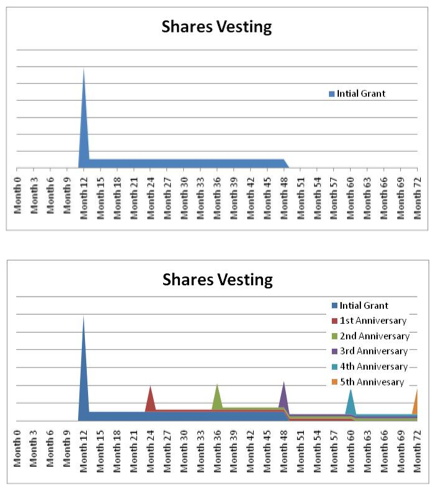

Initial options will usually vest over four years with a 12-month cliff (since the average startup will take five years to exit, I’m a fan over longer exercise periods). The number of shares that vest per month looks like the blue area here. You can see that an employee in his third year has little additional vesting in front of him. To the extent that future vesting is a motivator (we wouldn’t have issued the options if we didn’t believe that was true), that motivation has diminished and may have little meaning.

If we embrace the reality of a longer term to exit and the need to keep employees motivated with a train of future vesting (see our notes on the evils of acceleration elsewhere), we should establish a program for annual re-charging of options at diminished levels to provide for a long-term flow of vesting. Such a program usually allows for smaller initial options with follow-on options at around ¼ of the initial grant. The amount of follow-on options then varies based on company dilution and company and individual performance. It’s the existence of the program that is important – the details of the follow-on amounts will change with the circumstances.

Bonuses don’t exist so that we can over-reward people with compensation that the market doesn’t require. Our concept of bonus is tied to pay at risk. If we need to compensate an engineer at $100k, we’ll offer him a base pay of $90k and, say, a 15% bonus. Now, if he and the company do essentially what they’re supposed to do, he’ll make a little more but if one or both fails, he’ll make less. His $10k is at risk. Junior staffers can still be part of this concept but with much smaller amounts at risk. When we pay bonuses, we allow them to pay over target amounts (we usually cap at 150% of target) for times when the individual and/or the company exceeded plan.

When we talk about performance, we have two factors: company and individual. Most of us understand individual assessments and the annual performance review process. One of our rules here is that performance reviews are done on an annual cycle, not on anniversary dates. It’s hard enough to get managers to produce these reviews when we have everyone in the company focused on it. They simply don’t happen (yes, we’ve tried) without an annual event and forcing function that company-wide publicity provides.

But how about that other component? The company’s performance is often overlooked or it’s sort of factored in after the fact with a board or management that decides bonuses need to be cut or not paid. Get proactive. Determine what the company’s quantifiable objective is for the year. This is a great opportunity for your massive whiteboard thermometer that you can update every week or month. It’s the goal that everyone sees in the breakroom. It’s the target that shows up at the top of everyone’s individual performance objectives.

These goals can be one thing (say, revenue) or several. The target can be quantified as stated or it can be something qualitative (like release v 2.0 by October 1) that become quantitative.

Microgreen Polymers used three items, each weighted 1/3 in their first Company Performance Factor (CPF): revenue; margins; and operating expenses. The board approved the targets and we measured against them monthly and drilled down on each at weekly management meetings. The CPF provided a great vehicle to unite the shop floor working with the Chairman of the Board.

With regard to stock options, most firms issue them at time of hire but they lack any strategy for issuances after that. If we assume that the company’s benefit of issuing stock options is employee retention then we need to appreciate the need for follow-on options.

Bonuses don’t exist so that we can over-reward people with compensation that the market doesn’t require. Our concept of bonus is tied to pay at risk. If we need to compensate an engineer at $100k, we’ll offer him a base pay of $90k and, say, a 15% bonus. Now, if he and the company do essentially what they’re supposed to do, he’ll make a little more but if one or both fails, he’ll make less. His $10k is at risk. Junior staffers can still be part of this concept but with much smaller amounts at risk. When we pay bonuses, we allow them to pay over target amounts (we usually cap at 150% of target) for times when the individual and/or the company exceeded plan.

When we talk about performance, we have two factors: company and individual. Most of us understand individual assessments and the annual performance review process. One of our rules here is that performance reviews are done on an annual cycle, not on anniversary dates. It’s hard enough to get managers to produce these reviews when we have everyone in the company focused on it. They simply don’t happen (yes, we’ve tried) without an annual event and forcing function that company-wide publicity provides.

But how about that other component? The company’s performance is often overlooked or it’s sort of factored in after the fact with a board or management that decides bonuses need to be cut or not paid. Get proactive. Determine what the company’s quantifiable objective is for the year. This is a great opportunity for your massive whiteboard thermometer that you can update every week or month. It’s the goal that everyone sees in the breakroom. It’s the target that shows up at the top of everyone’s individual performance objectives.

These goals can be one thing (say, revenue) or several. The target can be quantified as stated or it can be something qualitative (like release v 2.0 by October 1) that become quantitative.

Microgreen Polymers used three items, each weighted 1/3 in their first Company Performance Factor (CPF): revenue; margins; and operating expenses. The board approved the targets and we measured against them monthly and drilled down on each at weekly management meetings. The CPF provided a great vehicle to unite the shop floor working with the Chairman of the Board.

With regard to stock options, most firms issue them at time of hire but they lack any strategy for issuances after that. If we assume that the company’s benefit of issuing stock options is employee retention then we need to appreciate the need for follow-on options.

Initial options will usually vest over four years with a 12-month cliff (since the average startup will take five years to exit, I’m a fan over longer exercise periods). The number of shares that vest per month looks like the blue area here. You can see that an employee in his third year has little additional vesting in front of him. To the extent that future vesting is a motivator (we wouldn’t have issued the options if we didn’t believe that was true), that motivation has diminished and may have little meaning.

If we embrace the reality of a longer term to exit and the need to keep employees motivated with a train of future vesting (see our notes on the evils of acceleration elsewhere), we should establish a program for annual re-charging of options at diminished levels to provide for a long-term flow of vesting. Such a program usually allows for smaller initial options with follow-on options at around ¼ of the initial grant. The amount of follow-on options then varies based on company dilution and company and individual performance. It’s the existence of the program that is important – the details of the follow-on amounts will change with the circumstances.

Initial options will usually vest over four years with a 12-month cliff (since the average startup will take five years to exit, I’m a fan over longer exercise periods). The number of shares that vest per month looks like the blue area here. You can see that an employee in his third year has little additional vesting in front of him. To the extent that future vesting is a motivator (we wouldn’t have issued the options if we didn’t believe that was true), that motivation has diminished and may have little meaning.

If we embrace the reality of a longer term to exit and the need to keep employees motivated with a train of future vesting (see our notes on the evils of acceleration elsewhere), we should establish a program for annual re-charging of options at diminished levels to provide for a long-term flow of vesting. Such a program usually allows for smaller initial options with follow-on options at around ¼ of the initial grant. The amount of follow-on options then varies based on company dilution and company and individual performance. It’s the existence of the program that is important – the details of the follow-on amounts will change with the circumstances.